- Start date

- Duration

- Format

- Language

- 19 Nov 2025

- 2,5 days

- Blended

- Italian

Il corso apre le porte al mondo della valutazione dell’impatto sociale.

Can art be considered a financial asset? What economic dynamics influence its value? What financial tools can support collectors, investors, and institutions in the art market? SDA Bocconi is bridging the worlds of finance and art, establishing itself as a global reference point to understand the intersection of the two worlds.

The Intensive Program in Art Markets and Finance, also offered as a specialized concentration within the Master in Arts Management and Administration (MAMA), was led by Andrea Rurale, MAMA 2025 Director, and explored the mechanisms of the art market with a scientific and multidisciplinary approach. Brunella Bruno, Researcher at the Department of Finance, Bocconi University, opened the discussion by introducing the conceptual framework that links art and finance, highlighting both the similarities and differences between these two fields. A keynote speech by Christl Novakovic, UBS Head of Wealth Management EMEA, provided exclusive insights into the role of financial institutions in art market analysis and advisory services for collectors and investors.

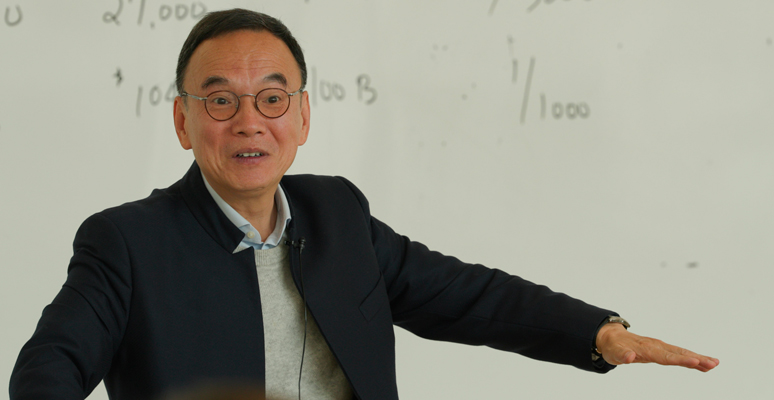

Among the notable contributions, Jianping Mei, Professor of Finance at NYU Stern and Cheung Kong Graduate School of Business, Shanghai, and creator of the Sotheby’s Mei Moses Index, offered an in-depth analysis of long-term value trends in the art market. His index is widely regarded as the leading benchmark for tracking art market performance, and his intervention placed particular emphasis on developments in the Chinese market.

Beyond financial considerations, the program also tackled legal issues and risk management within the art sector. Paula Trommel, Global Compliance Officer at Hauser & Wirth, addressed key topics such as anti-money laundering (AML) regulations, economic sanctions, and international taxation, while Pierre Valentin, Art Lawyer, examined legal challenges related to authenticity, ownership, and the cross-border movement of artworks.

Sophie Neuendorf, Vice President of Artnet, provided valuable insights into the importance of price transparency and big data in art market analysis. Drew Watson, Managing Director of Art Services at Bank of America, examined collector behavior and evolving investment strategies, highlighting how young ultra-wealthy buyers increasingly approach art with a financial mindset.

The discussion then shifted to the role of cultural institutions: Andrea Rurale, program director of Intensive Program in Art Markets and Finance, analyzed how museum collections contribute to legitimizing artistic value, while Cristiano De Lorenzo, Managing Director Italy at Christie’s, explained how auction houses and collectors shape the circulation and valuation of artworks. A key focus was dedicated to the protection of cultural heritage, with Giuseppe Marseglia, Commander of Group North-Central Italy at the Carabinieri Tutela Patrimonio Culturale, presenting real-life cases of illicit art trafficking and the law enforcement strategies used to combat these crimes.

This initiative represented a significant advancement in the analysis of the art market, providing a unique and innovative approach that integrates economic, legal, and historical perspectives. By bridging these disciplines, SDA Bocconi has solidified its role as one of the very few academic institutions worldwide capable of addressing these topics with scientific rigor and the direct involvement of leading industry experts. Through this interdisciplinary dialogue, the school continues to set a benchmark for understanding the increasing financialization of the art market.

SDA Bocconi School of Management

Il corso apre le porte al mondo della valutazione dell’impatto sociale.

To grasp international art market dynamics and understand the roles of collectors, investors, galleries, advisors, fairs, and auction houses.